A Guide to ASC 606 Compliance for SaaS Businesses

Before the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB) introduced ASC 606, methods and practices for SaaS sales commission expense accounting varied significantly across businesses.

The new standard outlines a comprehensive five-step model for revenue recognition, including sales commission expenses, aiming for greater consistency across various industries.

Broadly, the move from ASC 605 to ASC 606 brought in a more structured and unified framework across industries, aimed at enhancing transparency, standardization, and comparability in revenue recognition practices, reflecting a broader and more principles-based approach to accounting for revenue.

This blog will explore the changes brought by ASC 606 in the area of sales commission expensing. We will also look at ways and tools for SaaS companies to navigate this change and stay compliant.

Whether you're just starting to adapt to the new guidelines or seeking to optimize your current processes, this article aims to be your compass in the evolving world of SaaS sales commission expense accounting and ASC 606 compliance.

What is ASC 606 Compliance for SaaS?

ASC 606 is a comprehensive and transformative accounting standard that addresses revenue recognition. The core principle of ASC 606 is that a company should recognize revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the company expects to be entitled in exchange for those goods or services.

ASC 606: Five-Step Model for Revenue Recognition

The essence of the ASC 606 revenue standard lies in faithfully representing the transfer of promised goods or services to customers, aligning with the anticipated consideration an entity expects in return.

Entities encounter substantial decision-making complexities when assessing the appropriate recognition of revenue from customer contracts. This decision-making process is crucial in the five-step framework of the revenue standard, guiding entities on the timing and magnitude of revenue recognition.

- Identify the contract with the customer. This involves ensuring that there's a mutual understanding and agreement between the parties.

- Identify the performance obligations in the contract. These are the distinct goods or services that the company has promised to transfer to the customer.

- Determine the transaction price. This is the amount the company expects to receive in exchange for transferring the promised goods or services.

- Allocate the transaction price to the performance obligations. If a contract has multiple performance obligations, the transaction price needs to be allocated to each one based on its standalone selling price.

- Recognize revenue when (or as) the company satisfies a performance obligation. Revenue is recognized when control of the goods or services is transferred to the customer, either over time or at a point in time.

Endorsed by the Securities and Exchange Commission (SEC) as the revenue recognition standard, ASC 606 was designed to provide a more consistent and transparent method for recognizing revenue and expenses across industries, ensuring that financial statements are more comparable and understandable for investors and other stakeholders.

🔔 Also read: The Essential Guide to ASC 606 SaaS Revenue Recognition in 2024

ASC 606 Commission Amortization and Expensing for SaaS

Let's use the example of a software company that sells a bundled package for $10,000, which includes a three-year software subscription and a two-day training session. For every sale made, a salesperson receives a commission of $1,500.

Before ASC 606:

Revenue Recognition:

- Software License: Recognized immediately upon sale or perhaps evenly over the three years.

- Training Session: Recognized when the training was delivered.

Sales Commission Expensing:

- The $1,500 commission paid to the salesperson was immediately recognized as an expense upon the sale.

Financial Impact:

If the software subscription revenue was recognized immediately, then both the revenue and the commission expense would hit the financials at the start. If the revenue was spread over three years, there would be a mismatch, with the commission expensed immediately but the revenue recognized over three years.

ASC 606's Five-Step Model:

Step-1: Identify the contract with a customer

The company enters into a contract with a customer for a three-year software license and a two-day training session.

Step-2: Identify the performance obligations in the contract

- Software License on Platform Subscription: A distinct obligation to provide access to the software over three years.

- Training Session: A distinct obligation to train the customer over two days.

Step-3: Determine the transaction price

The bundled package is sold for $10,000.

Step-4: Allocate the transaction price to performance obligations

- Software License: Allocated $9,000 based on standalone selling prices.

- Training Session: Allocated $1,000.

Step-5: Recognize revenue when (or as) the company satisfies a performance obligation

- Software License: $9,000 recognized evenly over the three-year period ($3,000 per year).

- Training Session: $1,000 is recognized once the two-day training is completed.

Sales Commission Expensing under ASC 606

The $1500 commission undergoes financial accounting treatment, being capitalized as an asset and then amortized over the three-year period, reflecting the principles of ASC 606.

Pro tip: In SaaS, roles like Inside Sales Reps and SDRs might earn commissions for short-term actions like monthly subscriptions or demo setups. Under ASC 606, such commissions, not directly tied to long-term sales outcomes, might be expensed immediately. Ensure your commission recognition aligns with the nature of the SaaS sales cycle and the associated role's responsibilities.

Financial Impact by the end of Year 1 under ASC 606

- Revenue: Reflecting accrual accounting principles, 1/3 of the annual revenue from the software subscription ($3000) and the full training session revenue ($1000) are recognized, totaling $4000.

- Sales Commission Expense: Only 1/3 of the commission expense ($500) is recognized.

- The remaining commission ($1,000) is recorded as an asset on the balance sheet and will be expensed over the next two years.

This approach ensures that the commission expense aligns with the revenue it helped generate, providing a clearer representation of the company's financial performance for each year of the contract.

Benefits of ASC 606

- Balanced Reporting: This overview demonstrates how ASC 606, aligning with International Financial Reporting Standards (IFRS), only expenses a portion of the commission ($500) in Year 1.

- Clearer Profit Picture: Spreading the commission expense over three years avoids a one-time financial hit, giving a truer representation of Year 1 profitability.

- Economic Accuracy: By spreading the commission cost over the contract's life, financial statements better mirror the real-world transaction.

Under ASC 606, sales commissions that are directly attributable to securing a contract can be capitalized and then amortized over the expected period of benefit, typically the customer's lifetime or the contract's term.

If you're interested in learning more, here's an in-depth video explanation by FASB.

Can SaaS Sales Commissions automation help with ASC 606 compliance?

For CFOs and financial controllers, the treatment of sales commissions under ASC 606 has direct implications for financial reporting as it alters how commissions appear on financial statements. This change not only affects the accuracy and transparency of reporting but also plays a significant role in budgeting and forecasting processes.

Additionally, while the cash outlay for commissions is immediate, the deferred expense recognition under ASC 606 can influence cash flow projections, making it essential for finance leaders to adjust their financial strategies accordingly.

Ways in which SaaS sales commission software can help:

- Accuracy in Commission Calculations: With an emphasis on disclosures to reduce inconsistencies, the software ensures precise calculations of commissions based on each individual's compensation plan.

- Data Consistency: With a centralized system for commission calculations, CFOs benefit from consistent data across the organization. This uniformity is essential when determining costs related to ASC 606.

- Audit Trails: The software offers a clear record of how each commission was determined, providing transparency into the sales compensation process, a vital aspect of ASC 606 compliance.

- Efficiency and Best Practices: Leveraging software-as-a-service (SaaS) solutions like Incentive Compensation Management (ICM) can streamline the entire process of handling variable compensation and commission calculations, embedding industry best practices while reducing errors and saving time.

- Integrations: The calculated commissions from the software can be integrated with CRMs like HubSpot, Salesforce, and other financial systems that handle ASC 606 processes, ensuring a seamless flow of data for CFOs and financial controllers.

- Budgeting and Forecasting: By offering insights into expected commission payouts, the software aids CFOs and financial controllers in anticipating future cash flows and making informed financial decisions in line with ASC 606.

- Documentation: Storing details of each compensation plan, associated sales, and resulting commissions can be beneficial when assessing ASC 606 requirements, ensuring all relevant data is readily available.

Sales commission software provides CFOs and financial controllers with accurate, consistent, and transparent data, streamlining operations and ensuring that the sales commission component of their financials aligns with ASC 606 requirements.

🔔 Deep dive: ASC 606 and Sales Commission Accounting

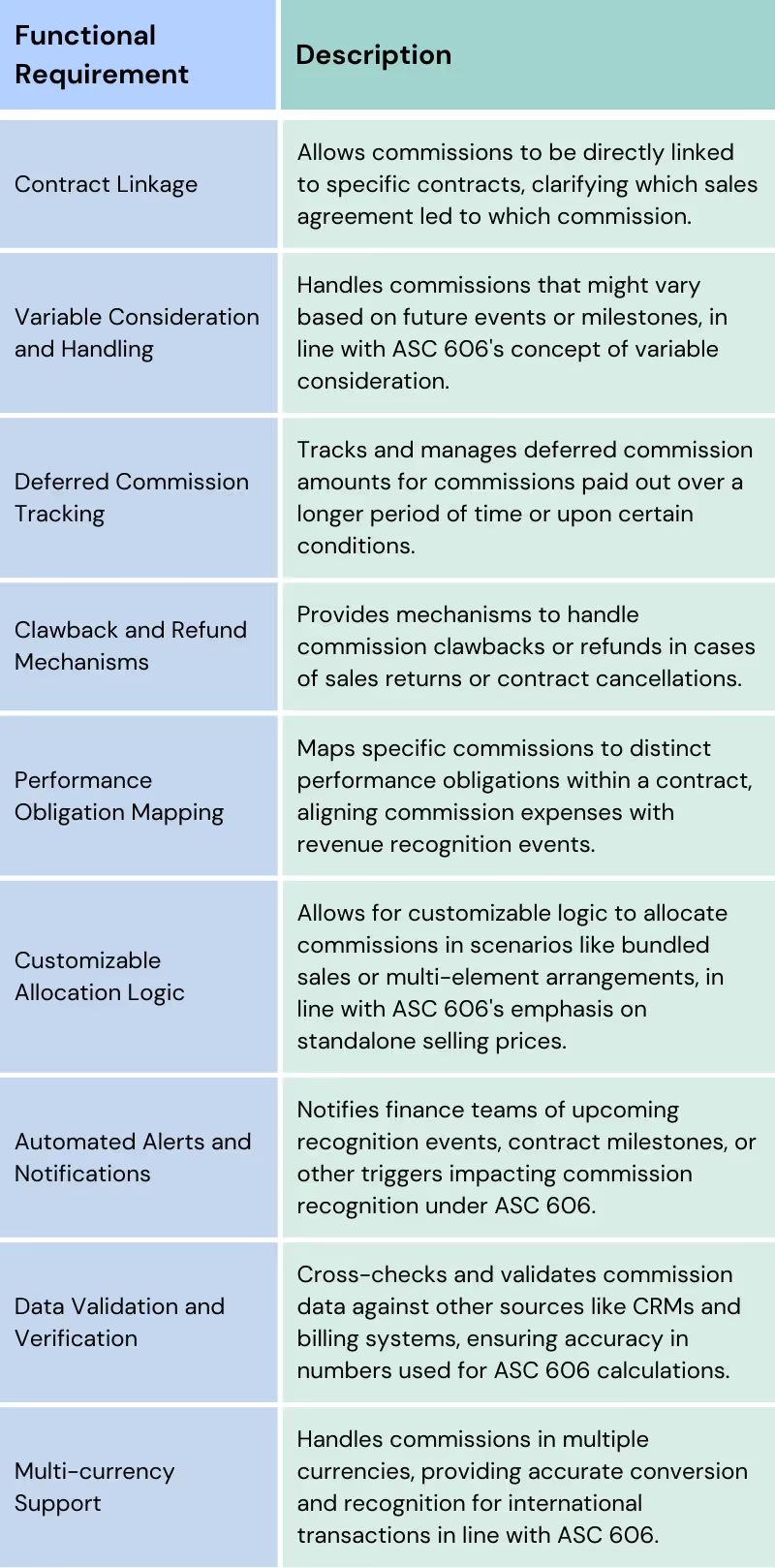

Functional Requirements for Audit Ready ASC 606 Compliance

Before diving into the types of commission-expensing tools, it's crucial to understand the functional requirements for ASC 606 compliance. For a CFO, ensuring ASC 606 compliance would focus on the following streamlined functional requirements:

Every CFO and Financial Controller would prioritize a solution that's comprehensive yet user-friendly, ensuring ASC 606 compliance while offering flexibility and insights for effective revenue management.

Four Types of Sales Commission Expensing Software

Let's evaluate each type of sales commission expensing software based on our discussions about ASC 606 compliance and the functional requirements.

Manual Commission Expensing (Spreadsheets/Excel)

Using spreadsheets or Excel for commission expensing is a manual approach. While it offers flexibility, it can be prone to errors, especially when dealing with complex commission structures and ASC 606 requirements. It might be suitable for smaller businesses with straightforward commission plans but can become cumbersome as the business grows or as commission structures become more intricate.

🔔 Read more on why spreadsheets are the wrong choice for sales commission tracking and expensing.

White Label/Custom Built Software

White Label or custom software is tailored to a company's specific needs. It can be designed to handle unique commission structures and can be integrated with other systems. However, it might require significant upfront investment and ongoing maintenance.

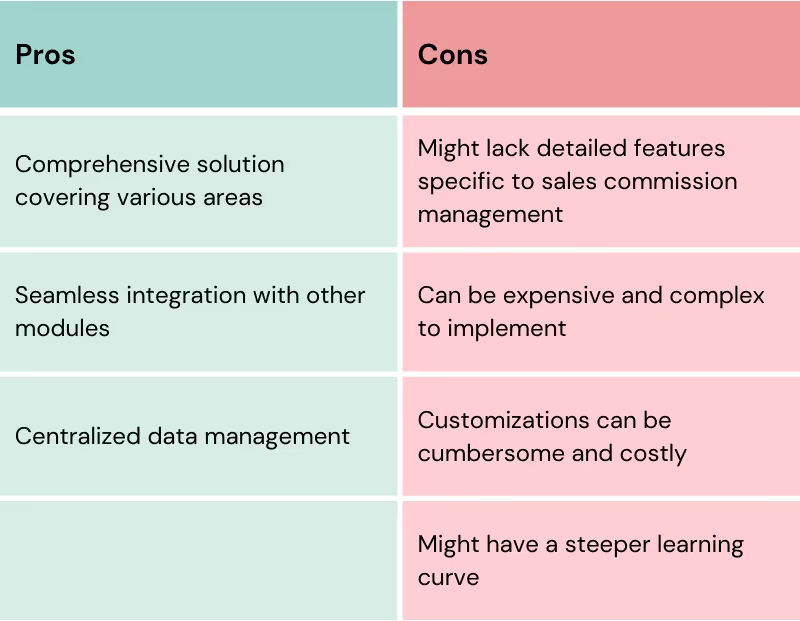

ERP (Enterprise Resource Planning)

ERPs are comprehensive systems that handle various business processes, including finance. While they can manage sales commissions, they might not have the granularity or flexibility of specialized commission software. They also require significant investment and dedicated human resources to manage.

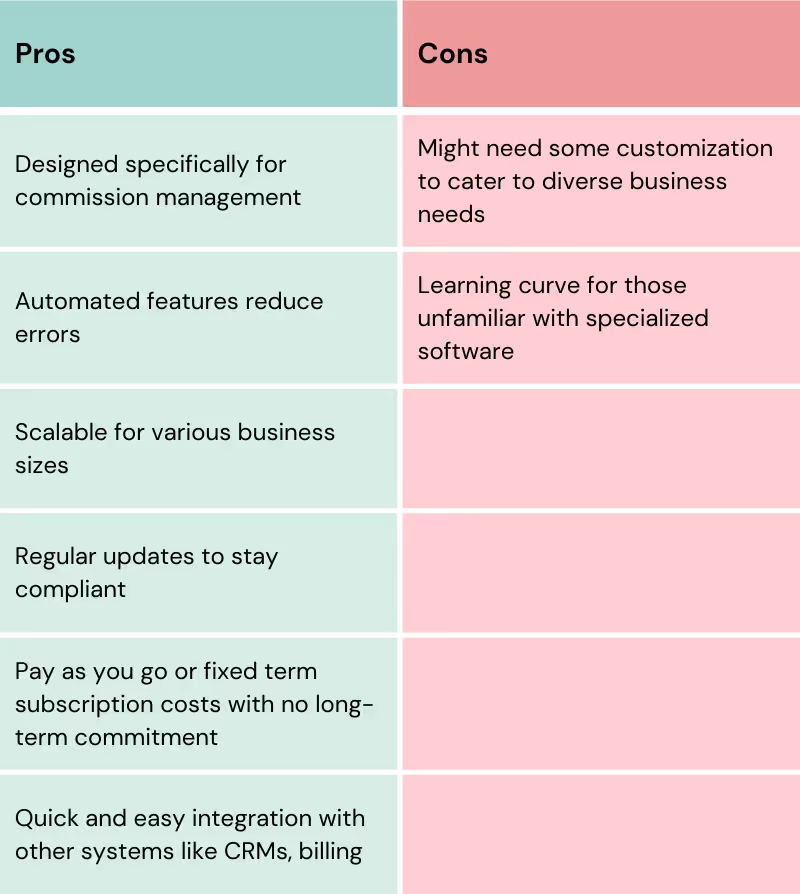

Automated SaaS Sales Commission Software

This type of software is specialized for sales commission management. It's designed to handle the intricacies of commission calculations, tracking, and reporting. Given its focus, it's likely to be the most aligned with ASC 606 requirements, especially if it's a modern solution like Visdum that’s aware of the standard.

While each option has its merits, the choice largely depends on the business's size, complexity of commission structures, budget, and how integral commission management is to its operations.

Factors to consider when selecting a sales commission tool for ASC 606

Choosing the right tool is like selecting the perfect vehicle for a long journey. It's essential to consider the terrain (your business needs) and the distance (scalability). Here are some factors to guide your choice:

- Assessing organizational needs: Every organization is unique. Understand your revenue streams, sales strategies, and reporting requirements to choose a tool that aligns with your needs.

- Prioritizing integration: A tool that doesn't integrate well can lead to data silos and inefficiencies. Ensure seamless integration with your existing systems.

- Considering scalability: Your chosen solution should grow with you. As your business expands, the tool should adapt without requiring major changes.

- Seeking robust support: Implementation is just the beginning. Opt for solutions that offer training, customer support, and regular updates to ensure you remain compliant and efficient.

In conclusion, while the journey to ASC 606 compliance might seem daunting, the right commission expensing tool can make it smoother. Among the options, "Automated Sales Commission Software" like Visdum stands out as an ideal choice, offering automation, accuracy, and ease of use.

Evaluate your options, consider your organization's unique needs, and embark on this journey with confidence.

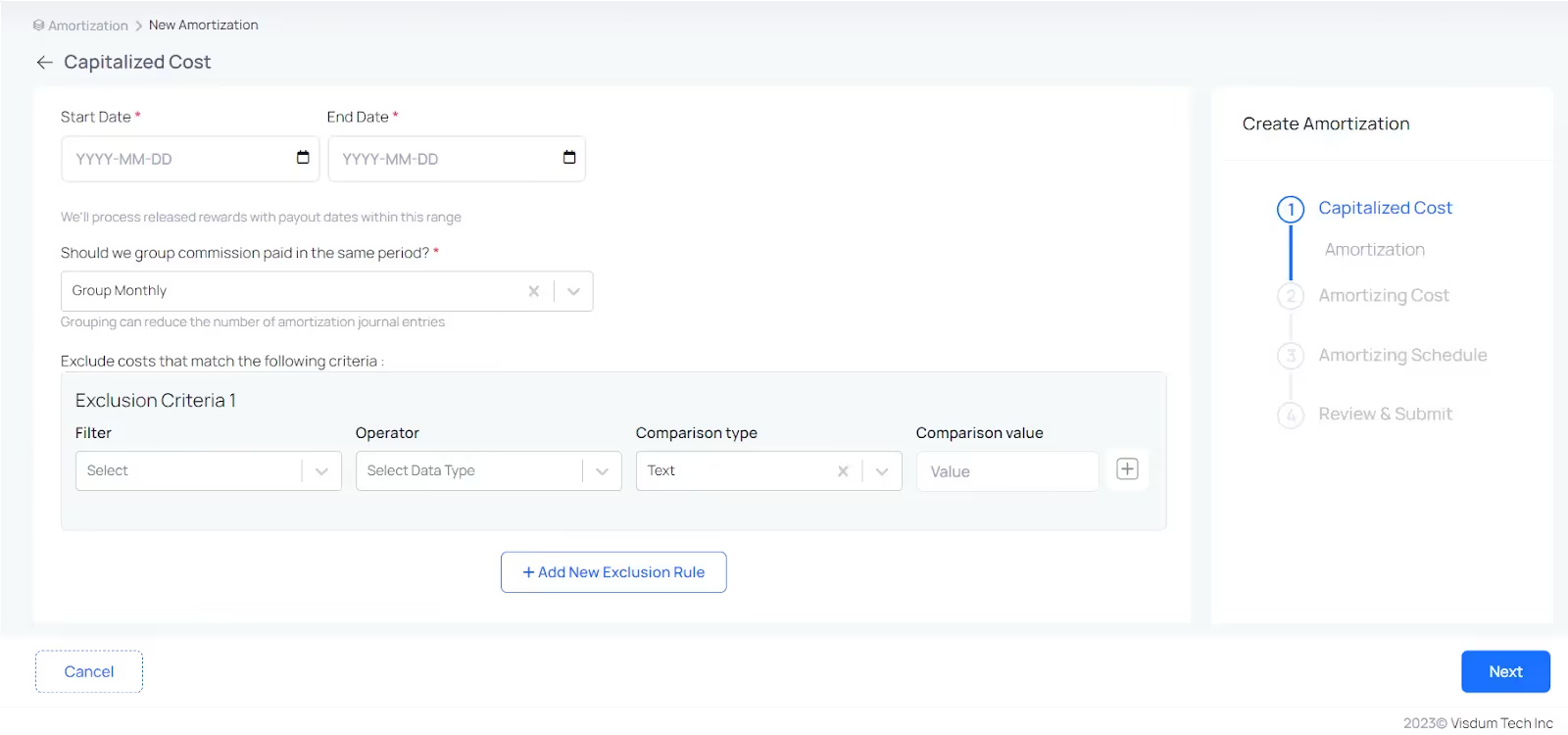

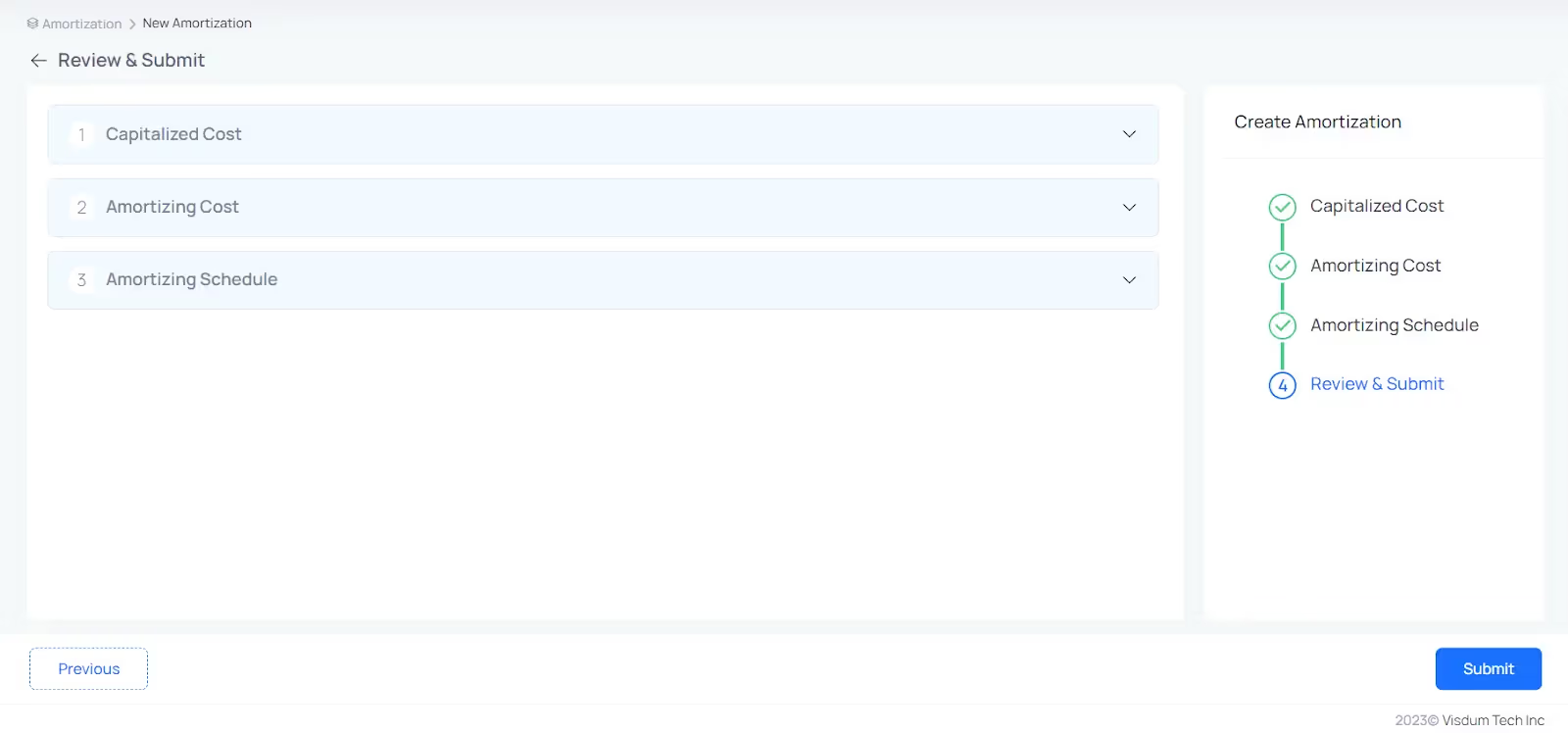

Automate ASC 606 Sales Commission Accounting in Four Simple Steps

Visdum is not just another sales commission software; it's a solution built with the intricacies of SaaS commission structures in mind. Recognizing the unique challenges and requirements of ASC 606, Visdum offers a suite of features that make compliance straightforward and efficient.

Transform your approach to ASC 606 compliance with Visdum, tailored for SaaS sales commission accounting. Experience the ease of automation and accuracy that come with our intuitive features and seamless integrations.

Select your dates

Choose the commission dates you need to process. Whether it's monthly, quarterly, or yearly, we've got you covered.

Customize Your Criteria

Effortlessly group transactions and set specific criteria to exclude certain commissions, like those paid to business development and customer success teams. Gain control over what you capitalize on.

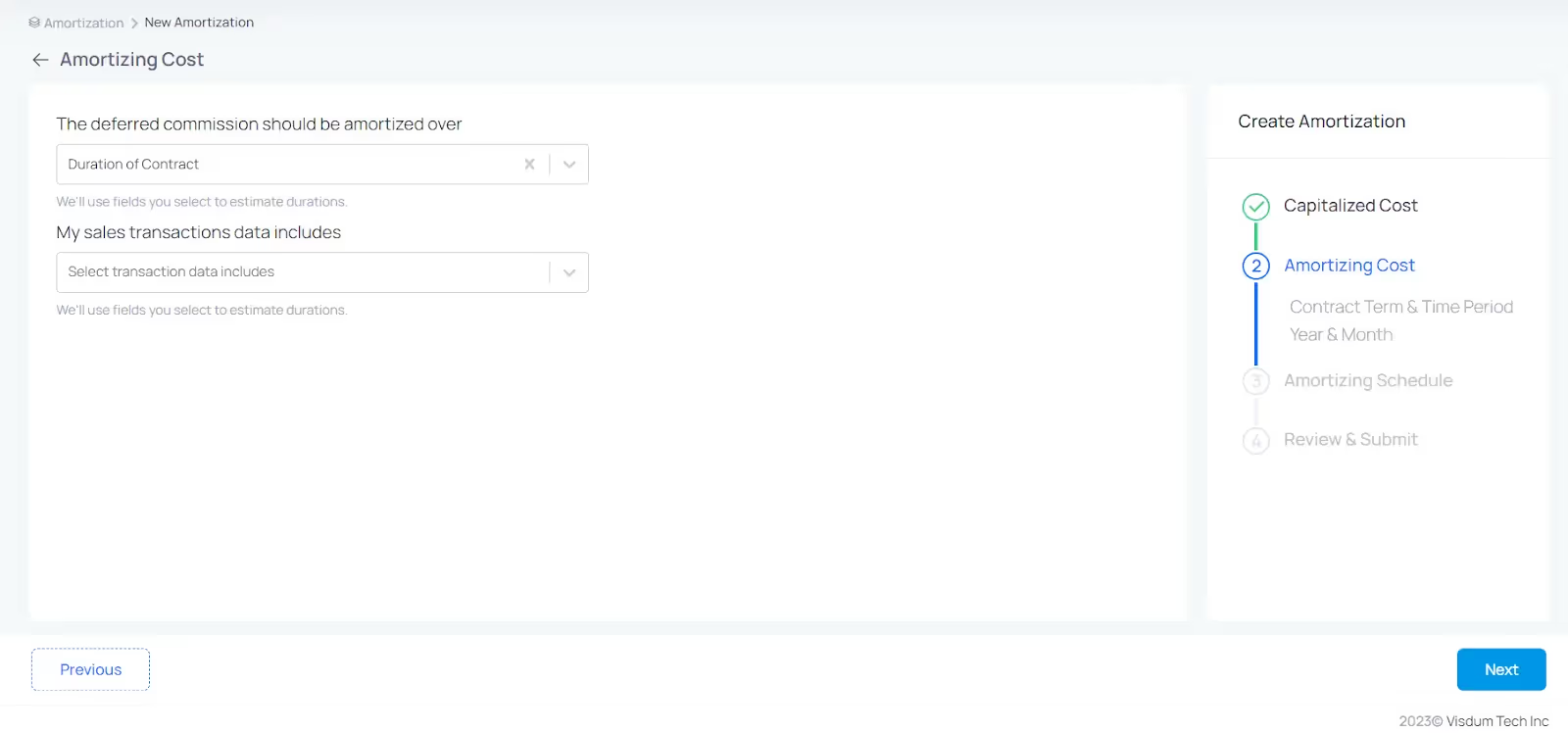

Amortization Choices

Decide how you want to amortize commissions over the contract period or the estimated lifetime of the customer relationship.

Seamless Data Mapping

Easily map your data streams and generate comprehensive sales commission reports for full ASC 606 compliance.

Are you ready to revolutionize your sales commission accounting?

With Visdum, you're not just complying with ASC 606; you're setting a new standard in efficiency and accuracy for your financial operations. Make the smart choice today.

By choosing Visdum, SaaS companies not only streamline their commission processes but also fortify their financial reporting. The software's capabilities ensure that revenue recognition and commission expensing are in perfect harmony, as mandated by ASC 606.

Dive into the world of Visdum and experience seamless, accurate, and efficient commission tracking. Elevate your financial reporting and ensure unwavering compliance with ASC 606.

Start your Visdum journey today!

FAQs

Is ASC 606 mandatory?

Yes, ASC 606 is mandatory for companies following Generally Accepted Accounting Principles (GAAP) in the United States. This includes both public and private companies.

What is the principle of ASC 606?

The core principle of ASC 606 is to recognize revenue in a way that reflects the transfer of goods or services to customers at an amount that reflects the consideration a company expects to receive in exchange for those goods or services.

Who does ASC 606 apply to?

ASC 606 applies to entities that enter into contracts with customers to transfer goods or services. This includes public companies, private companies, and nonprofit organizations that follow GAAP in the United States.

Who issues ASC 606?

ASC 606 is issued by the Financial Accounting Standards Board (FASB), which is the organization responsible for establishing accounting and financial reporting standards in the United States.

.webp)

.webp)